Upcoming school projects are focus of financial summit

This week’s financial summit focused on upcoming capital projects, and what the tax implications could look like.

While the town’s annual financial summit serves as an opportunity for officials to unveil their priorities for the upcoming fiscal year, much of Monday’s discussion was focused on the potential financial impact of the upcoming middle school and high school campus building project and how its price tag may impact Weston’s future affordability.

Each year, the Select Board, Finance Committee and School Committee come together in the fall to lay out their preliminary thoughts at the start of the budget cycle, while town staff share their thoughts on the town’s financial indicators and concerns for the year ahead.

With the town currently in a solid financial position, discussion revolved around the number of capital projects underway and in the planning process in the coming years – including the water tanks, fire station and school campus.

In particular, the discussion focused on the ongoing exploration of renovating the schools versus constructing new buildings. Estimates for the project range from $172 million for renovating the buildings to more than $400 million for construction, depending on which option is selected. There is an opportunity for some state funding through the Massachusetts School Building Authority if Weston is selected to join its construction program.

For the purpose of preliminary financial analysis, Finance Committee Chair Bharath Venkataraman used $330 million as a “conservative” estimate, and expressed concern about adding significant debt to the town’s finances.

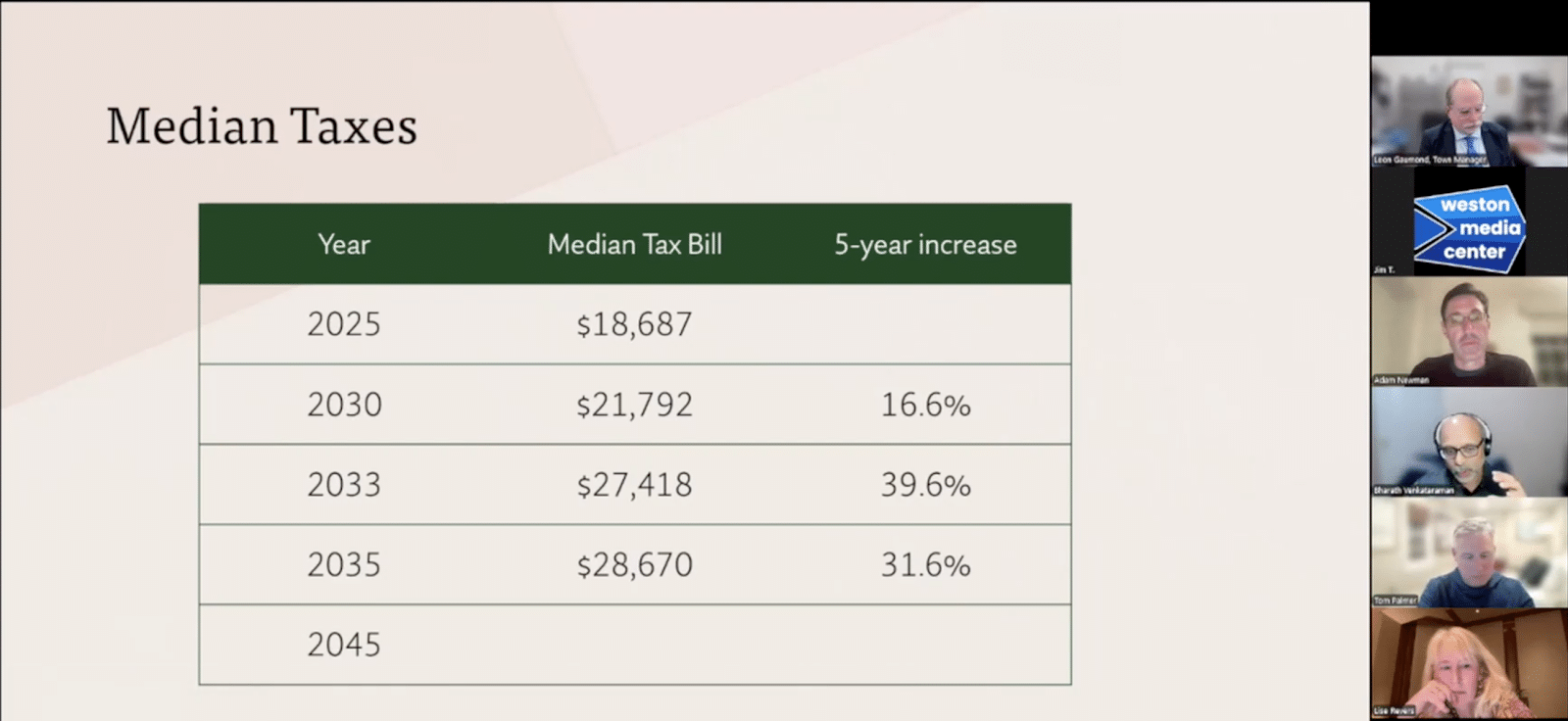

Residents’ tax bills typically rise about 16% over five-year periods, Venkataraman said, but, if the town borrows the full $330 million for the school project, taxes would rise about 40% from 2028 to 2033. The median tax bill for 2025, currently $18,687, could rise to a peak of $27,418 by 2033 if the school debt is taken on, and would decrease as debt is paid off, according to Venkataraman.

“We’re asking about 70% of the town, which does not have kids in the schools, to pay 24% more taxes for those years, after which it slowly starts to come down,” Venkataraman said.

Resident Rochelle Nemrow said these preliminary tax bill projections raise concerns about the future affordability of Weston.

“We’re looking at tax increases that are just enormous … we really have to look at whether we’re going to be creating a situation where residents literally cannot afford to live here,” Nemrow said. “Everyone who is working on this, this is going to be really hard, but I can just tell you as a resident, that what I’m hearing is very difficult to take.”

Conversations continue

While there are several options under consideration for the school plan – public information sessions on the campus feasibility study have been held during the last two weeks – the School Committee emphasized it will spend at least the next 10 months or so collecting feedback from the community before asking for any funding.

“We anticipate working to build consensus, get feedback, sharpen the plan,” School Committee Chair Adam Newman said. “We are looking toward next fall as the window when we would bring this discussion more formally to the broader town community.”

As conversations on capital projects continue, Venkataraman said Weston needs to explore every option possible for each project to ensure costs are reasonable.

“We have to reduce the costs of the projects, with a focus on needs, not wants,” he said. “The fact is that every little bit matters, so it’s really important we look at every project and we keep these costs down.”

Financial health and future concerns

Town Manager Leon Gaumond kicked off the financial summit with a presentation on the town’s financial health, which includes an “Aaa” credit rating from Moody’s.

There are some concerns for Fiscal Year 2027 and beyond, although several of them are recurring, he said. Among those areas of concern are a “very strong likelihood of double-digit increases” in health insurance expenses, uncertainty about potential state and federal aid cuts, ongoing union negotiations, inflation, recruitment and retention of town employees and large capital projects.

Gaumond said the town is analyzing potential future debt scenarios and has a preliminary capital expenditure plan through FY34. Additionally, the town has paid down $47 million of general debt service over the last five years, and $33 million is slated to be paid over the next five years.

There will be several opportunities for residents to learn about the upcoming budget. Over the next month, town departments will submit funding requests to Gaumond, who will then begin meeting with department heads in December. The town’s tax classification hearing will take place in early December. Then, in January, Gaumond will recommend a budget to the Select Board, which will adopt a final budget proposal for Town Meeting in March.

On the school’s side, Newman said residents are invited to the School Committee’s Dec. 15 meeting, for a preliminary presentation on the district’s investment priorities for the upcoming fiscal year.