FY26 Tax Rate set: What you need to know

The Select Board has adopted a fiscal year 2026 tax rate of $10.88 per $1,000.

The Select Board has set Weston’s fiscal year 2026 tax rate at $10.88 per $1,000.

Principal Assessor Eric Josephson made the tax rate recommendation to the board Tuesday afternoon, noting that the town will finally fall out of the top slot in the state’s average single-family tax bill rankings.

For at least the last five years, Weston’s average tax bill has been the highest in the commonwealth, according to state data. Josephson, however, said Tuesday that Weston’s new tax rate will see the town fall to the second-highest average tax bill in the state, as Brookline moves into the top spot.

“The tax levy is only up 3.5%; compared to a lot of surrounding communities, that’s on the low end,” he said, crediting “conservative budgeting and a well-run town.” “As of now, things look pretty good.”

Tax bill history

It can be expensive to live in Weston.

As budget season kicks into gear and the Select Board prepares to set the fiscal year 2026 tax rate in December, here is a primer on how tax bills are calculated, and a look at Weston’s tax history, according to data from the state Division of Local Services and the town’s annual reports.

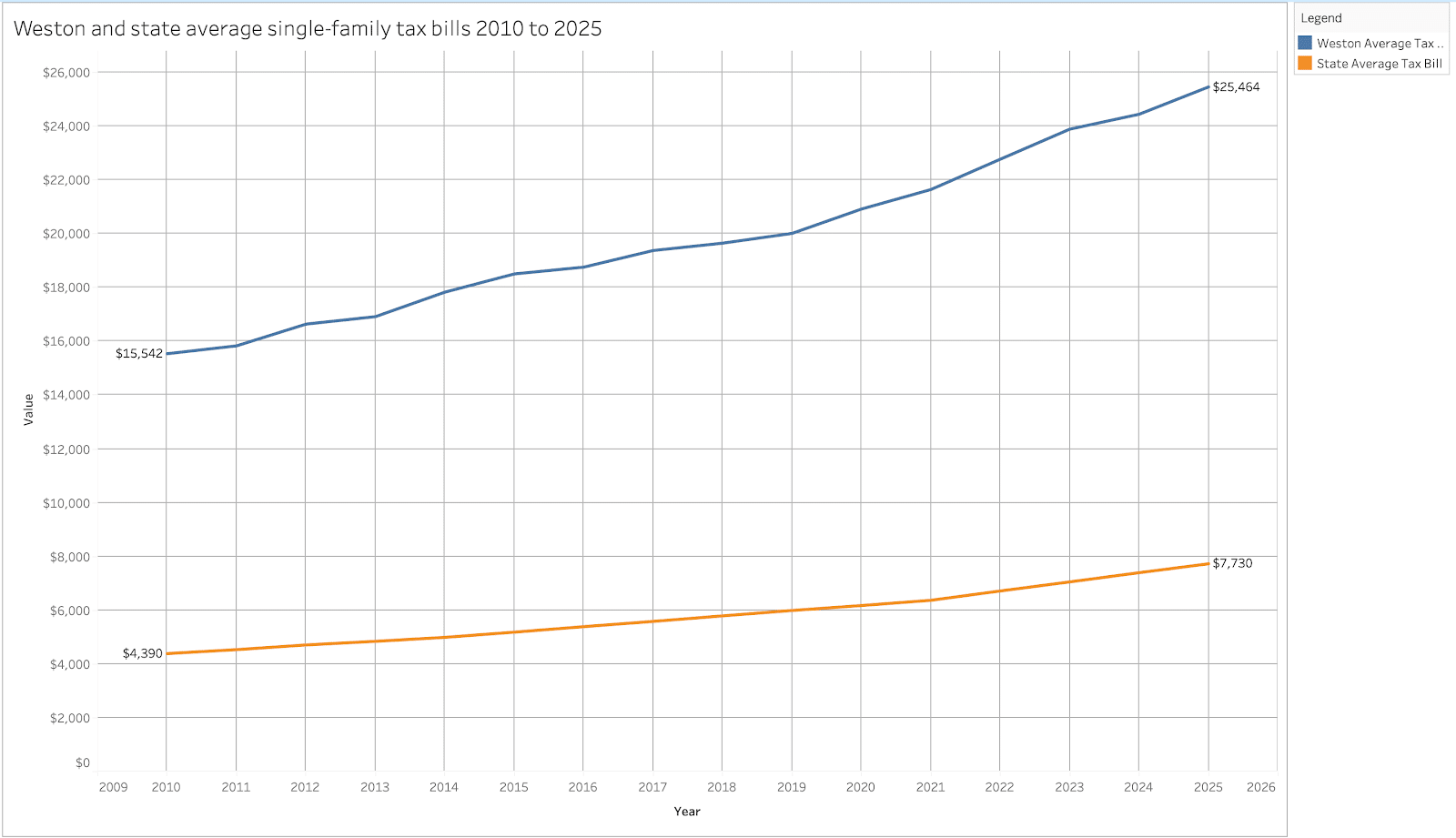

Since 2010, the average single-family tax bill has risen about 3.36% each year, with the average tax bill going from $15,542 to $25,464 in that period. In comparison, neighboring Wellesley’s average single-family tax bill has risen about 4.28% each year, with tax bills going from $10,581 to $19,792.

What do these tax payments afford residents? Weston residents enjoy high-quality town services, excellent schools and many other benefits that come with living in Weston.

“The bottom line for residents is that most of the taxes go toward schools and school benefits,” Finance Committee Chair Bharath Venkataraman said. In the most recent budget approved at the May Town Meeting, schools accounted for 42.7% and fixed costs – such as insurance for town and school employees – accounted for 20.9%.

Budget process

After voters approve the FY27 budget in May, the town will apply the prior year’s tax rates and property valuations for the third and fourth quarters of FY26. By the end of the year, once assessors finalize new valuations and add new construction to the tax rolls, officials will calculate how much revenue must be raised to fund the budget. The town divides the total tax levy by the total assessed value of all property to set the new tax rate.

At its most basic form, a resident’s tax bill (excluding the Community Preservation Act surcharge and any potential exclusions) is calculated by dividing a property’s assessed value by 1,000 and then multiplying that number by the tax rate. The FY25 tax rate approved by the Select Board is $11.10 per $1,000 of valuation.

The Select Board is expected to set the FY26 tax rate in December. The tax rate has decreased each year since its 26-year peak of $12.98 per $1,000 in 2021, according to the town website.

While the tax rate itself may decrease, that does not correspond to a lower tax bill. Tax bills increase even when the tax rate drops because rising property values and growing town budgets outweigh the rate reduction.

Property assessments represent the estimated market value of properties for the previous year. In Weston, assessments have risen every year since 2013 and at a much higher rate since the pandemic. Prior to 2020, the greatest assessment increase was 4.98% from 2014 to 2015. Following 2021, though, average assessed values increased 6.56% in 2022, 13.55% in 2023, 8.95% in 2024 and 4.34% last year.

It should be noted that an assessment increase does not always correlate to a tax increase. If the budget increases by 5%, then the tax increase would be around 5%, regardless of the overall assessment of values in town. If the tax rate increased 5% and all assessed values went up by 20%, then the average tax increase would still be 5%, according to an information sheet compiled by the Assessors’ Office.

Josephson said in an interview that the housing market drives assessments, and the advent of remote working allowed people to purchase homes further from their offices. That factor, combined with low interest rates and strong municipal services in Weston, he added, likely drove the increases in assessments.

“In some cases, there was no need to be in Boston because they were working fully remotely or partially remotely, which is still occurring somewhat today. That created a demand for housing in communities north, south, east and west of Boston,” he said. “Weston, specifically, is known for their great school system … I think people are overall very happy with the local government as well.”

As the pandemic continues to fall further in the rearview mirror, Josephson said interest rates will be the biggest driver in future assessment trends.

“I don’t think it’s totally related to the pandemic. We’re far enough past that. It’s always been driven by interest rates and I think… the Fed is going to continue to lower rates,” he said. “I think there will always be a high demand for housing. We haven’t really seen a drop in the market here since the late ‘90s.”

State comparisons

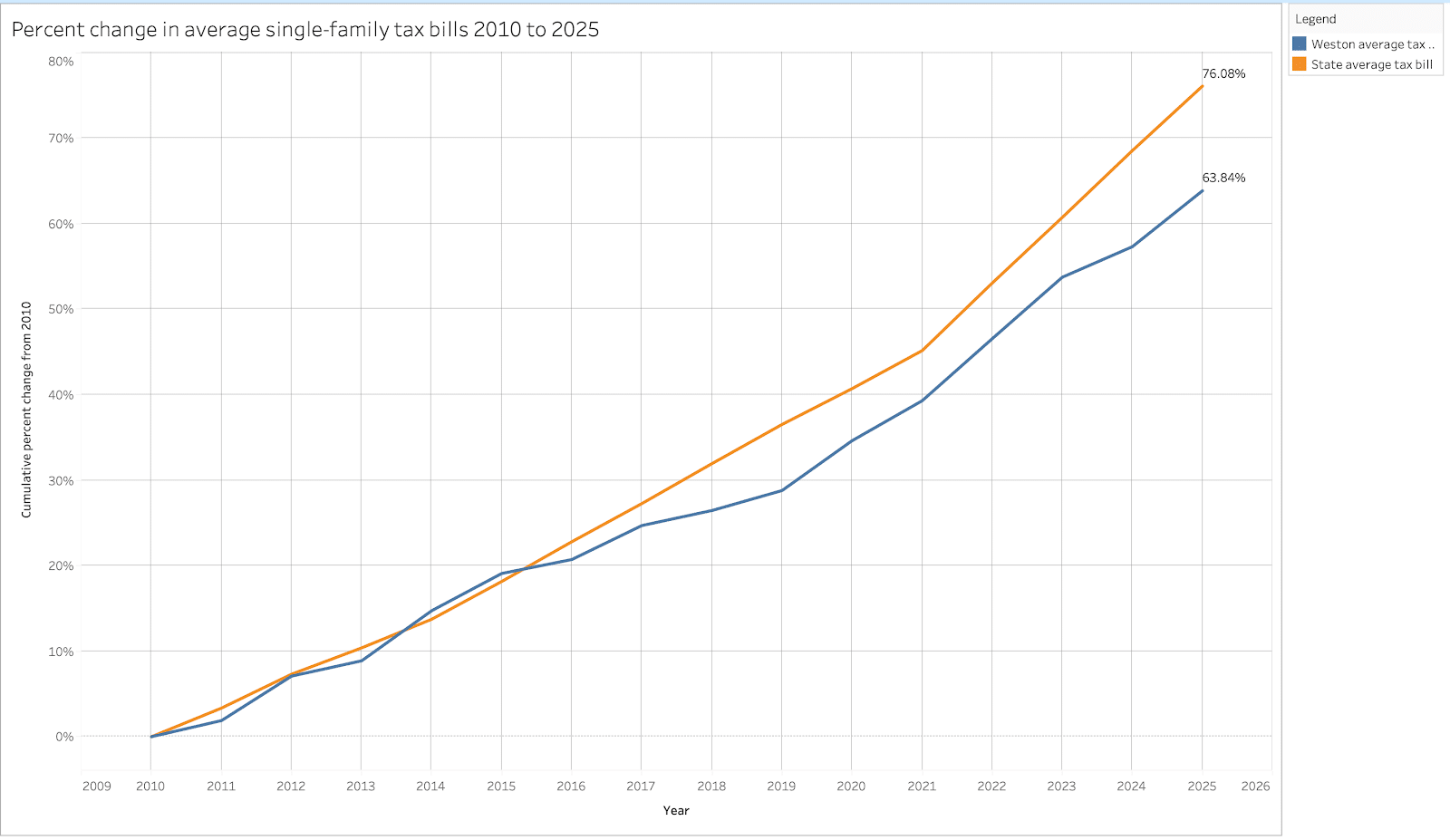

Over the last 15 years, both Weston’s average single-family tax bill and assessed value have increased by 63.84%, translating to increases of $9,922 and $893,867, respectively.

While those raw numbers are higher than the state’s average single-family tax bill and assessed value, the percent change is actually lower. In the same period, the state’s average single-family tax bill rose 76.08% and assessed values increased 88%, which corresponds to $3,340 more in taxes and $328,858 in assessed value.

Potential future impacts

Weston’s tax bills could increase further in the next 10 years, as there are several big capital projects on the horizon, including the fire station and the potential renovation or reconstruction of the Middle School and High School campus.

The school project, in particular, could greatly increase tax bills. Venkataraman, in a presentation during the town’s annual financial summit, said a “conservative” estimate of $330 million for the school could increase tax bills by 40% from 2028 to 2033. Typically, tax bills increase about 16% over five-year periods, according to Venkataraman.

In total, the median tax bill (not the average, which can be affected by outliers) would rise from the 2025 value of $18,687 to a peak of $27,418 by 2033 if the school debt is taken on.

“There will always be these big projects; you can’t avoid it,” Venkataraman said, noting the town has avoided taking on more debt in recent years because of big projects on the horizon.

“Planning is the key aspect of how you handle these big projects,” he continued, “and the town is doing a good job of doing that, and I hope people feel that way too.”